🧠 I. From Environmental Concern to Economic Conditioning

For decades, environmental campaigns have asked us to reduce, reuse, and recycle. But in recent years, the climate conversation has shifted — from encouraging individual awareness to embedding behavioral expectations into the very systems that govern daily life.

This shift marks the convergence of two powerful forces: environmental morality and financial infrastructure. What happens when sustainability moves beyond advice and becomes algorithm? When your access to everyday goods, services, and spending is shaped by eco-scoring systems? And what happens when the guilt of noncompliance is used to justify it?

The intersection of climate guilt and financial control represents a subtle but profound transformation — from voluntary virtue to systemic regulation.

📉 II. The Carbon Ledger: When Spending Becomes Scoring

In several countries, the groundwork for carbon-based consumer profiling is already being laid.

-

In Sweden, major banks are issuing credit cards with built-in carbon limiters. Once your carbon quota is exceeded for the month, your card can pause discretionary spending.

-

In Canada, pilot programs are testing loyalty point systems that reward eco-compliant behavior — and quietly penalize non-compliant purchases.

-

In the EU, policymakers have circulated draft proposals for digital “Carbon IDs” that would assign emissions budgets to individuals — with automated enforcement mechanisms triggered by overspending.

These systems don’t need to be overt to be effective. The infrastructure for tracking, profiling, and scoring behavior already exists — in your phone, your bank account, your transportation apps. What’s changing is how that data is being interpreted.

A leaked 2023 white paper from a European sustainability policy group proposed:

“Carbon visibility must evolve into carbon accountability. Budgeted permissions, not just awareness, are the logical next step.”

Whether or not such a system becomes mandatory, the psychological groundwork is being laid — through social messaging, guilt-based incentives, and the redefinition of spending as environmental responsibility.

🌍 III. From Currency to Compliance: The CBDC Question

At the center of this transformation lies one key technology: Central Bank Digital Currencies (CBDCs). Promoted by several central banks as the future of efficient, trackable transactions, CBDCs are digital legal tender — programmable, traceable, and potentially restrictive.

Supporters tout the benefits: faster payments, reduced fraud, easier disbursement of welfare. But critics warn that programmability opens the door to precisely the kind of climate guilt and financial control now being explored behind closed doors.

Dr. Emilio Vargas, a digital finance researcher formerly with the IMF, explains:

“CBDCs could be designed to restrict certain purchases, apply dynamic pricing based on eco-scores, or expire funds that aren’t used ‘sustainably.’ That’s not theoretical — it’s programmable logic.”

Internal memos from two European central banks — made public via a whistleblower leak — confirm that carbon scoring is being considered in the development of programmable features. While these systems may begin as optional or incentivized, the potential for escalation is evident.

Imagine:

-

Being denied a second flight this month due to “emissions saturation”

-

Paying double for meat because your weekly climate threshold has been exceeded

-

Having your travel budget adjusted downward if your home energy usage is deemed excessive

In such a system, the line between financial service, and behavioral and financial control becomes blurred — justified, always, by a higher environmental purpose.

📎 IV. The Ethical Loophole: Guilt as Social Leverage

Throughout history, crises have often been used to justify systems of expanded control. What makes the climate crisis unique is the emotional universality of the message. It’s not just a policy issue — it’s a moral one. And morality, once institutionalized, becomes a tool of conformity.

Those who question carbon scoring, programmable spending, or eco-driven restrictions are often met with accusations of selfishness, denialism, or anti-scientific thinking.

This emotional framing reinforces compliance not through force, but through self-regulation. As one anonymous policy advisor admitted:

“Concerns about freedom were dismissed internally as individualist resistance. It’s seen as a feature, not a flaw, that people feel guilty for questioning the system.”

In this context, climate guilt and financial control become twin levers: one emotional, one structural — both working toward behavioral alignment.

🌐 V. Related Reading: Wired – “What Programmable Money Really Means”

This external deep dive by Wired outlines how programmable digital currency features could be implemented and what risks they pose — not just for freedom of transaction, but for behavioral autonomy itself.

🧾 VI. The Illusion of Consent: Convenience as Conditioning

One of the most effective strategies in this transformation is the rebranding of restriction as convenience.

-

Smart meters provide efficiency — while tracking home energy behavior

-

Biometric wallets enable seamless payment — while profiling your purchases

-

Carbon footprint calculators “help you stay informed” — while building your behavior model

At every turn, systems that collect and analyze your actions are introduced under the banner of innovation and sustainability. But over time, the outputs of those systems — eco-scores, behavioral flags, and consumption limits — may determine not just how you shop, but how you live.

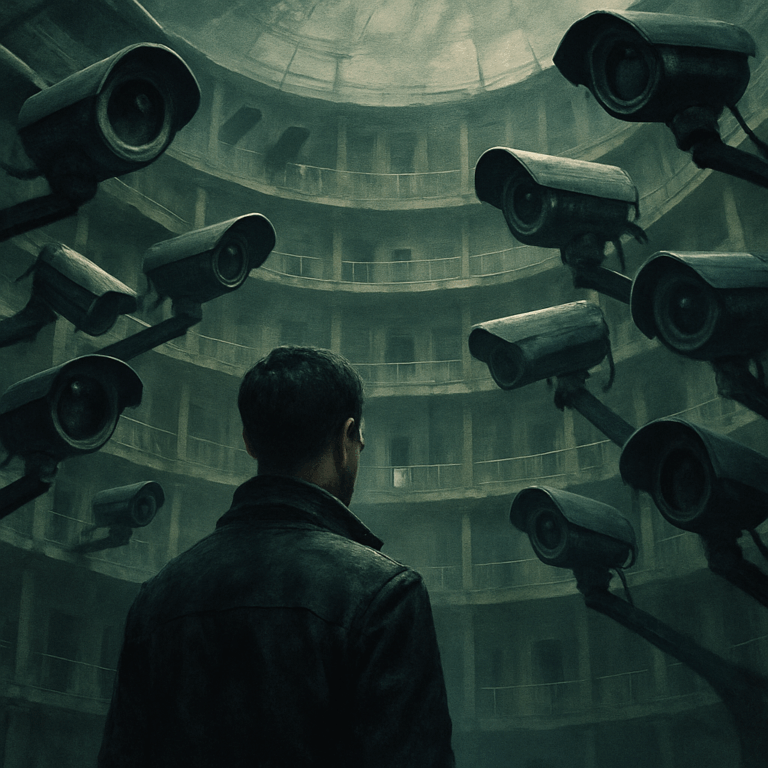

Psychologists warn of a creeping internalization of surveillance. When individuals begin measuring their moral worth by their consumption data, the system no longer needs enforcement — compliance becomes a social instinct.

“You don’t push back,” says behavioral theorist Dr. Noelle Hart. “You adapt — because guilt has taught you to.”

⚖️ VII. A Question of Fairness — Or Obedience?

What’s missing from much of the public climate discourse is a real discussion of equity and agency.

While ordinary consumers are being asked to modify their diets, cancel travel, and surrender privacy — major polluters continue operations with minimal restrictions. Financial firms tout ESG compliance while investing in high-emission portfolios. Celebrity climate advocates arrive at summits in private jets.

The narrative says, “We’re all in this together.” But the reality suggests otherwise.

In a carbon-scored society, those with wealth may bypass restrictions entirely — purchasing carbon offsets, paying eco-penalties, or simply being exempt due to corporate classification.

This creates a two-tier system:

-

Conditional access for the majority, based on compliance

-

Unrestricted privilege for those in control of the system

It’s not just about climate anymore — it’s about structure, control, and the ethics of authority.

🔒 VIII. When Financial Autonomy Becomes a Threat

One of the most sobering aspects of this trend is the silencing of dissent under the guise of environmental urgency.

In internal policy circles, resistance to behavior-based spending control is framed as obstructionism. In public discourse, skepticism is equated with denial. And in media, emotional appeals often replace factual complexity.

This dynamic creates a chilling effect — where the desire to question systems of control is overridden by the fear of being labeled immoral.

“You’re not told what to think — but you’re shown what happens to those who don’t conform,” said one whistleblower from a climate finance regulatory body.

“It’s not censorship. It’s incentive design.”

🧭 IX. Where Do We Go From Here?

To be clear: addressing environmental harm is important. Climate change, whether man-made or otherwise, presents real challenges. But how we respond to those challenges matters just as much as whether we acknowledge them.

If guilt becomes a gateway to financial control, and sustainability becomes a tool for surveillance, then we must ask:

-

Are we empowering individuals — or scripting their behavior?

-

Are we solving problems — or building systems that require them to persist?

-

Are we protecting the planet — or seizing the opportunity to reshape society?

🧠 X. Conclusion: Between Hope and Hegemony

There’s a difference between informed responsibility and manipulated obedience. Between choosing sustainability and being graded by it.

As the architecture of programmable finance and behavior tracking expands, it is essential to maintain public dialogue — not just about environmental outcomes, but about process, power, and permission.

Because the real future we face may not be ecological collapse — but moral automation, where systems decide what is right, and individuals comply to feel clean.

And if that’s the future, we should ask: Whose system is it? And who does it serve?